Mister Mortgage discusses the way you use guarantee to invest in a second family and how a bridging mortgage really works about Netherlands.

Are you experiencing intentions to offer your current house and get an alternate domestic? Earliest, you will want to decide whether or not we should promote your current home and you may transfer to your domestic or come across another type of family and you may proceed with the product sales of one’s current family after to the. How come they works economically once you currently have a home loan? Would you like to use your guarantee to buy your 2nd house?

What is collateral?

Mortgage collateral is the difference between what you owe for the lending company therefore the house’s value. Through payments toward bank each month, youre enhancing the guarantee in your home. In the event the property value a house has grown, it indicates you really have centered positive guarantee, and you may withdraw the new guarantee to get an additional house.

What’s bad collateral?

Whenever a home loan exceeds the worth of property, this new guarantee is actually negative. Negative collateral is sometimes a direct result construction pricing drastically decreasing. Your home is onder liquids (underwater) if your financial exceeds the guarantee.

Yes, you can use family guarantee buying a moment assets. Equity can be used to minimise the expenses of buying an effective second house.

- You create monthly premiums with the home loan company

- The house really worth grows if your housing market was good

- Your remodel making developments to your home

How will you determine the newest collateral out-of a house?

Get in touch with a representative to find out the worth of your home. Comparable characteristics obtainable in new neighbourhood may also give you understanding towards value of your home.

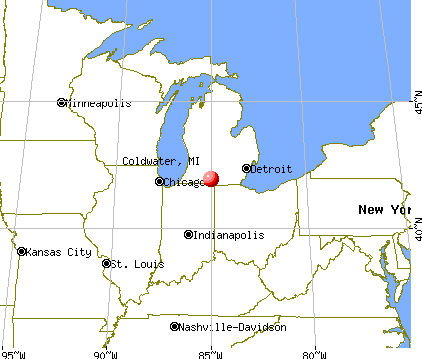

Dutch housing

The newest Dutch housing industry will continue to do strong. Low interest is the essential driver to higher prices and therefore usually results in confident equity. One of the major Dutch banking companies needs casing prices to increase of the twelve,5 per cent in the 2021 and you can five percent from inside the 2022.

What exactly is a connecting financing

A connecting loan are a short-name loan that can help you connection this new pit involving the price of the new house and you may looking after your current mortgage until their dated you to offers. Permits one to use the guarantee in your current home to the down-payment in your brand new home. You only pay (triple) monthly premiums provided the new bridging mortgage are energetic: the expense of one’s most recent mortgage, the expense of your own the latest financial, while the attract on your own link loan. Because of this, the loan seller will always be find out if you possibly could San Jose savings and installment loan pay for multiple mortgage payments.

How do connecting finance functions?

You could potentially plan a bridging financing along with your newest bank. Bridging money aren’t always easy to obtain once the loan providers believe this type of financing high-risk. Once your home is offered, the newest bridging financing is paid down. You’re not permitted to use the loan for any other mission. A connecting loan you will history any where from 1 to 2 years. Particular banks even have faster terms.

What is the limit connecting amount borrowed?

The credit is utilized to fund the fresh new guarantee in your house. To find the equity, a beneficial valuation is required. In most financial institutions, the maximum credit number try 90 % of reviewed value.

Month-to-month can cost you and you will bridging loan

You only pay an interest rate towards a bridging mortgage and that varies for every single home loan company. Ergo, the new monthly payments is high. Brand new connecting financial focus was taxation-deductible. When you promote your old household, you pay it well. Its strongly suggested to consult a home loan coach observe whether or not you really can afford the fresh charge. Understand that new product sales of one’s history home could possibly get take longer than simply your assume.

Advantages of a connecting financing

- You can utilize the full time to market your home versus feeling stressed

- Your own equity can be used to make it easier to pick an alternate home

- A connecting financing is effective if you want to finance a beneficial brand new home

- If the home is sold, you could potentially pay off the financing immediately

Disadvantages from a bridging mortgage

- The expenses of your latest home loan, your brand new mortgage, as well as your bridging mortgage are highest into the connecting loan several months

- Lenders have various other conditions having connecting loans

Mister Mortgage offers monetary advice for very first-go out homeowners, some body moving homes, and get-to-let and refinancing ventures. They believe inside transparency, ethics, and you may development to possess a shiny upcoming. Please visit the fresh Mister Home loan website to look for facts about mortgages in the Netherlands.

Recent Comments