Of numerous lenders favor not to lend so you can individuals which have fico scores regarding Bad diversity. This is why, what you can do to help you borrow funds and you may investment options are planning become very limited. Having a rating off five-hundred, the focus will likely be into the strengthening your credit history and elevating the credit scores before you apply the fund.

One of the recommended an easy way to generate borrowing from the bank is via being extra once the a third party affiliate by a person who currently enjoys high borrowing from the bank. That have individuals inside your life with good credit that will cosign to you personally is even a choice, nonetheless it normally harm its credit history if you skip payments or standard to the financing.

Could you score a credit card having a 500 credit rating?

Mastercard candidates which have a credit score inside variety may be required to lay out a safety put. Applying for a guaranteed credit card is probable the best option. But not, they often require deposits from $500 $step one,100000. You may want to be able to get a great starter credit card regarding a cards connection. It’s an unsecured bank card, but it includes a reduced credit limit and you may high attract rates.

Regardless, whenever you are able to find approved getting a credit card, you should make your payments on time and maintain what you owe lower than 30% of one’s credit limit.

Is it possible you rating a personal loan with a credit score off 500?

Not too many lenders will accept you to possess a personal bank loan that have a 400 credit score. However, there are a few that really work with less than perfect credit borrowers. But, signature loans from all of these lenders have higher interest rates.

It is best to stop payday loans and you will high-focus personal loans because they manage a lot of time-name obligations troubles and just sign up for a further decrease in credit rating.

To build borrowing from the bank, applying for a cards builder financing is a good idea. Rather than providing the bucks, the bucks is simply listed in a checking account. After you pay back the borrowed funds, you get access to the cash plus any attention accrued.

Must i rating a mortgage with a credit score regarding 500?

Old-fashioned mortgage lenders might refuse the job having a beneficial credit history out-of five-hundred, as the minimum credit score is approximately 620.

However, for these looking for trying to get an enthusiastic FHA loan, people are only necessary to keeps the absolute minimum FICO rating out-of 500 to help you be eligible for a down-payment of around ten%. People who have a credit rating regarding 580 americash loans Maysville, CO is also be eligible for an effective deposit as little as step three.5%.

Do i need to rating a car loan which have a four hundred credit rating?

Extremely vehicle lenders doesn’t give in order to some one having a 500 get. If you’re able to get acknowledged to own a car loan which have a 500 score, it could be costly. When you can raise your credit history, getting a motor vehicle might possibly be smoother.

Simple tips to Improve a 500 Credit history

A dismal credit score have a tendency to shows a track record of borrowing mistakes or problems. Eg, you may have certain missed costs, charges offs, foreclosure, plus a bankruptcy proceeding popping up on your own credit history. Furthermore possible that you only have not established borrowing from the bank after all. No borrowing is in fact the same as less than perfect credit.

step one. Disagreement Bad Accounts on the Credit history

It is best to pick up a duplicate of your free credit file regarding all the around three major credit reporting agencies, Equifax, Experian, and you may TransUnion to see what is being reported in regards to you. If you learn any bad situations, you could get a credit repair business such Lexington Legislation. Capable help you conflict him or her and maybe keep them removed.

Lexington Rules focuses on deleting bad issues from your own credit file. He’s got more than 18 numerous years of experience and now have removed more than eight billion bad situations for their website subscribers into the 2020 alone.

- hard issues

- later repayments

- choices

- charge offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

2. Pull out a credit Builder Financing

Borrowing creator financing is repayment financing which might be created specifically so you’re able to help those with less than perfect credit create or reconstruct credit history. Actually, borrowing builder money not one of them a credit assessment whatsoever. In addition to, it should be the least expensive and you will simplest way to boost their borrowing from the bank results.

Which have borrowing creator loans, the cash consist inside the a savings account up to you complete all the the monthly premiums. The borrowed funds repayments was reported to 1 credit bureau, that gives your own fico scores an improve.

step 3. Score a guaranteed Mastercard

Given that talk about before, getting a guaranteed bank card is a fantastic solution to establish borrowing from the bank. Covered credit cards work much the same due to the fact unsecured handmade cards. The only real variation is they require a protection put which also will act as your own borrowing limit. The financing bank will keep the deposit if you avoid making the minimal percentage otherwise are unable to pay your mastercard equilibrium.

cuatro. Be a third party Representative

If you’re alongside anyone who has advanced borrowing, getting an authorized user on their borrowing membership, is the quickest cure for improve fico scores. The account information becomes placed into your credit history, that will increase your fico scores quickly.

5. Generate Credit by paying Their Rent

Regrettably, book and you will electric repayments are not always claimed towards credit reporting agencies. Yet not, getting a tiny fee, lease reporting properties will add your payments on credit file, which will help your alter your credit scores.

Which place to go from this point

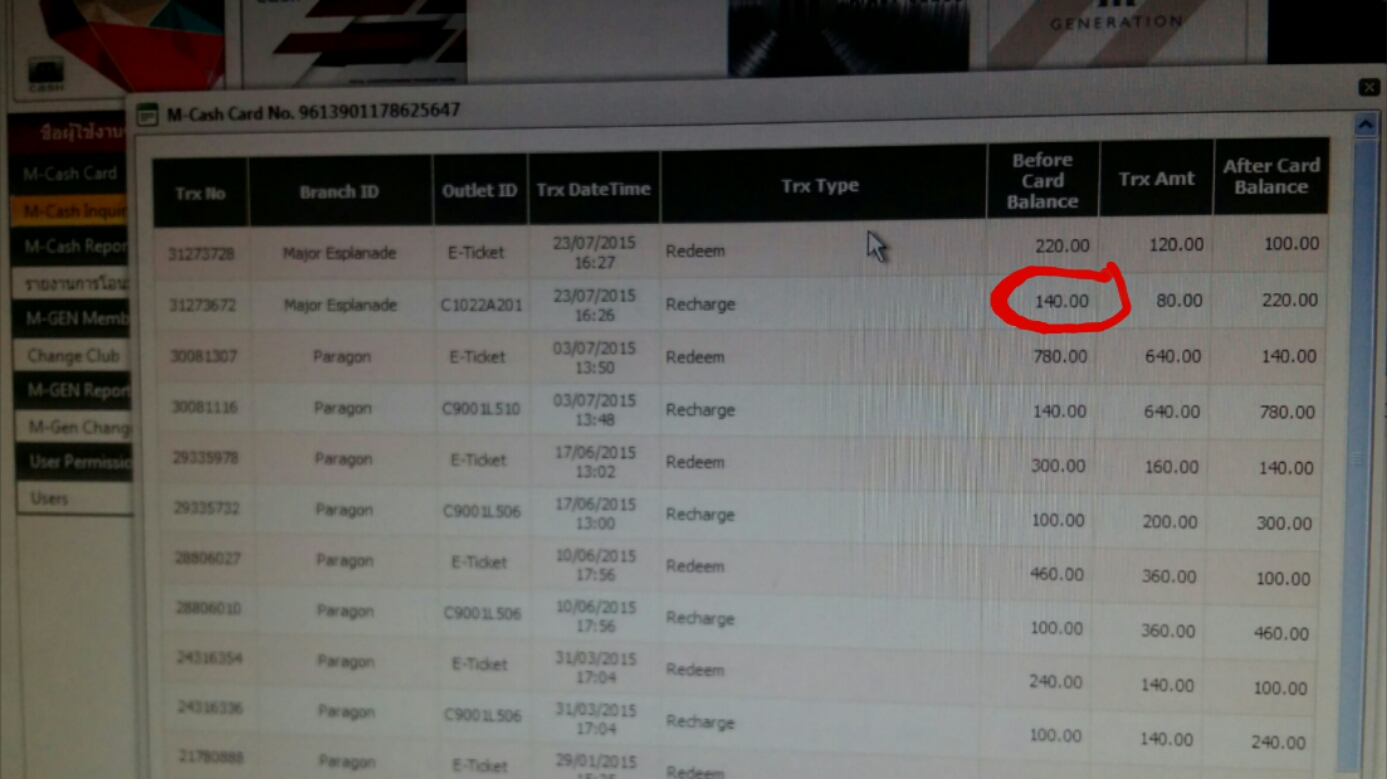

It is vital to understand and this things make up your credit rating. As you care able to see on image lower than, discover 5 issues that define your credit rating.

Lower the stability and keep your own borrowing from the bank utilization under 29%. Its also wise to has actually different varieties of borrowing profile to help you introduce a very good credit mix because it accounts for to 10% of FICO get. Very, you need to provides both payment and rotating borrowing showing up on your credit file.

Needless to say, you also should manage and also make punctual money from this point towards the away. Also one late fee can be hugely bad for your own borrowing.

Length of credit rating and takes on an essential character in your fico scores. We should let you know possible financial institutions you have a long, self-confident percentage records.

Building good credit will not happen quickly, you could definitely speed up the method by creating the newest best movements. Thus offer Lexington Rules a require a free of charge credit consultation at (800) 220-0084 and possess come restoring your borrowing now! The sooner you begin, the sooner you’ll end up on your journey to having good credit.

Recent Comments