- Are you willing to Continue All of the Money Once you Sell a house?

When you sell a property, you have got to very first spend people left amount in your financing, the real home broker you familiar with sell our home, and you will any charge otherwise fees you have incurred. Upcoming, the remainder count is your own personal to save.

Keeping money once attempting to sell a property isn’t necessarily the way it is. Repeatedly people nonetheless are obligated to pay on their loans and have now so you can use the money produced from its sale to pay for any kept mortgage equilibrium.

- Kept loan harmony

- Settlement costs

- Real estate agent percentage

- Necessary repairs

- Fees

Any cash remaining then is perhaps all your personal, but contemplate you will also need to pay fees inside it www.clickcashadvance.com/installment-loans-pa/austin/ in the event that you aren’t moving they with the to find other family within this a specific time.

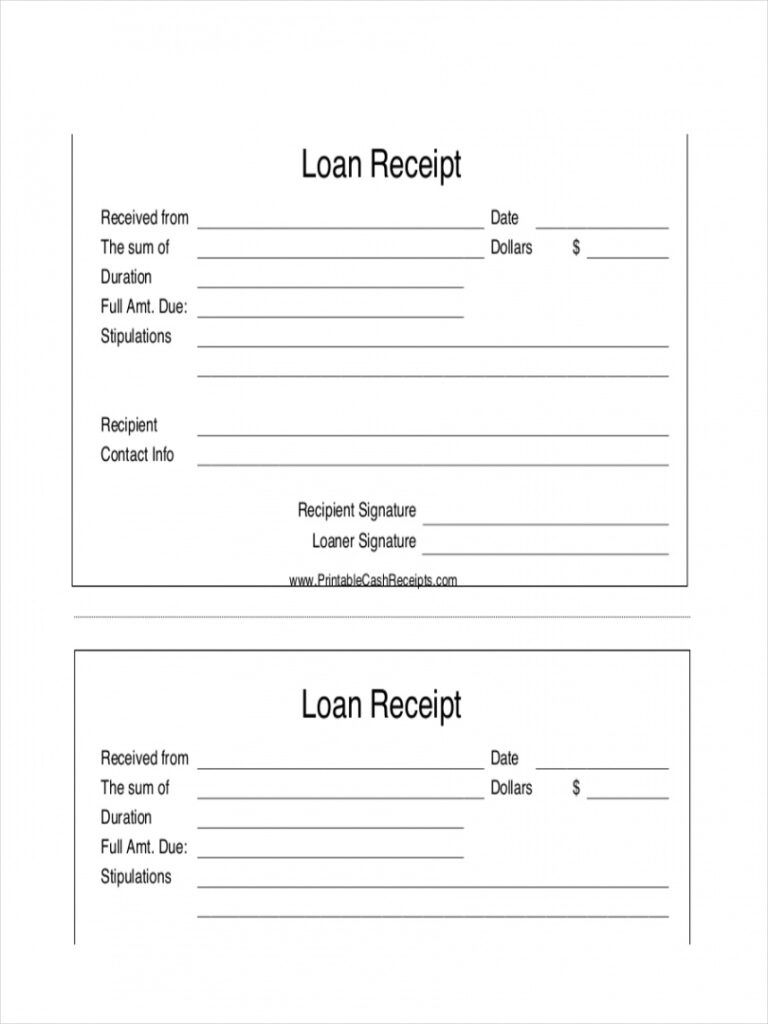

One of the primary metropolises your money could well be used out of attempting to sell a property ‘s the kept equilibrium on your financing when the you have got you to. Definitely, you will find a go which you paid all of your mortgage very you won’t need to worry about it prices shortly after selling your own household, but that is not necessarily the outcome.

Many times, anybody still owe money on the house they have been offering and get to use the money using their product sales to their leftover balance so they really cannot go into debt and their financial. It’s one of many defects regarding attempting to sell your residence prior to using of your own home loan.

The good thing about this really is if you have reduced an excellent tall percentage of your home loan then you may still have money left over immediately following selling your house based on how far currency you used to be in a position to bring in.

You have to pay settlement costs

Just like after you evaluated closing costs when you purchased our home, you may be as well as attending need to grounds them when you look at the when you sell it. Same as expenses your left financing balance, discover a spin you do not need to bother about this new selling money of your house supposed on the the settlement costs.

More often than not a contract can be produced between your domestic vendor and the home buyer in which included in this discusses this new closure will set you back. Constantly, each party safeguards her settlement costs whenever property are sold but that is never the actual situation. You could potentially negotiate that client talks about a number of the closing costs. From the properly performing this, you might stop paying closing costs and avoid allocating a few of your earnings on it costs.

Yet not, if you fail to end using closing costs it is finest to find out that the fee of one’s settlement costs tend to usually run you doing 5% in order to six% in fact it is mainly because you will be investing in the true home percentage.

You have to pay realtor earnings

As mentioned, very domestic vendors pay a real property payment because the chief fee within closing costs. Unless you are an agent your self, or you list your home fsbo plus don’t you want a provider representative, then you are going to need one to complete the records techniques on your own household and in actual fact discover buyers that can shell out your price tag. The price getting expenses a realtor isn’t any fun but at the same time it is expected.

That’s and as to the reasons the fresh new percentage of agent is actually among the many a few once you create an excellent revenue. It is most likely not some thing you’ll be able to prevent paying once you promote your property so be prepared for they.

Recent Comments