When you find yourself looking to get property, you may be wondering exactly how much your own student loan obligations often have an impact. Is it necessary to pay the financing basic prior to getting home financing? Or could you qualify which have student obligations?

Why don’t we glance at the most recent study to have responses. Performing this usually reveal what you could anticipate and you may which things to do alongside help make your dreams of homeownership possible. While each and every man or woman’s financial affairs was book, you’re closer to reaching your aim than do you think.

The same NAR report plus unearthed that a large number regarding home owners bring student loan financial obligation:

Nearly one-one-fourth of the many homebuyers, and 37 percent regarding very first-go out customers, had beginner financial obligation, with a regular level of $31,one hundred thousand.

This indicates you to definitely loads of someone else in a situation equivalent for you are eligible to find property, whilst settling figuratively speaking. You are too, particularly with constant income account.

The fresh new Federal Property Administration (FHA) together with generated changes in 2021 so you can how student loan debt try determined whenever qualifying for a keen FHA loan. So it changes may possibly provide the number one advantage to individuals holding brand new most debt.

In lieu of playing with 1 percent of usps direct deposit your total education loan balance in order to assess month-to-month student financial obligation, their real month-to-month student loan payment will today feel factored to the your debt-to-earnings ratio (DTI) when applying for a keen FHA financing. For the majority consumers, this leads to a critical DTI drop off and may allow it to be more straightforward to qualify for home financing.

Along with choosing the right financing program , there are numerous other ways making your self mortgage-in a position due to the fact a debtor that have college loans:

- Lower your DTI regardless of where you could. This may look like repaying most debt – in addition to personal credit card debt and private and you will car and truck loans. A nice-looking DTI is recognized as being below thirty six per cent. Regardless of if, loans supported by Freddie Mac computer and Fannie mae might have friendlier DTI limitations anywhere between forty five so you can 50 percent.

- Render your credit rating particular like. Each year, you are eligible to a totally free declaration of AnnualCreditReport. Read over your credit history to find out if discover one problems which might be solved right away. Following begin using effortless borrowing health techniques, if you are not currently, to optimize the rating – particularly expenses every expense punctually, ount off borrowing you may be playing with (called the borrowing from the bank use rates), and to stop high orders.

- Lookup advance payment recommendations. A reasonable mortgage program aimed toward very first-big date consumers – including a keen FHA, USDA, or Virtual assistant financing, just in case you be considered – can aid in reducing the fresh new initial cost of to find. As well as having fun with a community down payment advice program. Lookup the U.S. Agencies from Construction and you may Urban Development (HUD) databases to see which guidance software could be in your area, that have potential to decrease your down-payment because of the many.

- Mention increasing your earnings. This 1 may possibly not be offered to group. But it is really worth citing you to a quick solution to get rid of your own DTI is by improving your money top. This could seem like requesting overtime or a marketing at the job otherwise doing an area hustle. In order for added money so you can number with regards to their DTI, however, it should be regular and you will reputable.

The most significant takeaway is one, for the majority hopeful homeowners, homeownership is possible, even as carrying student loans.

The only way to know very well what home loan you might be entitled to are to get hold of a community loan administrator and you may prequalify. It’s not necessary to wade this alone. Contact an expert who’ll evaluate your unique financial picture and give you exact guidance you are able to and work out a choice you then become great about.

To acquire a home feels effortless when…

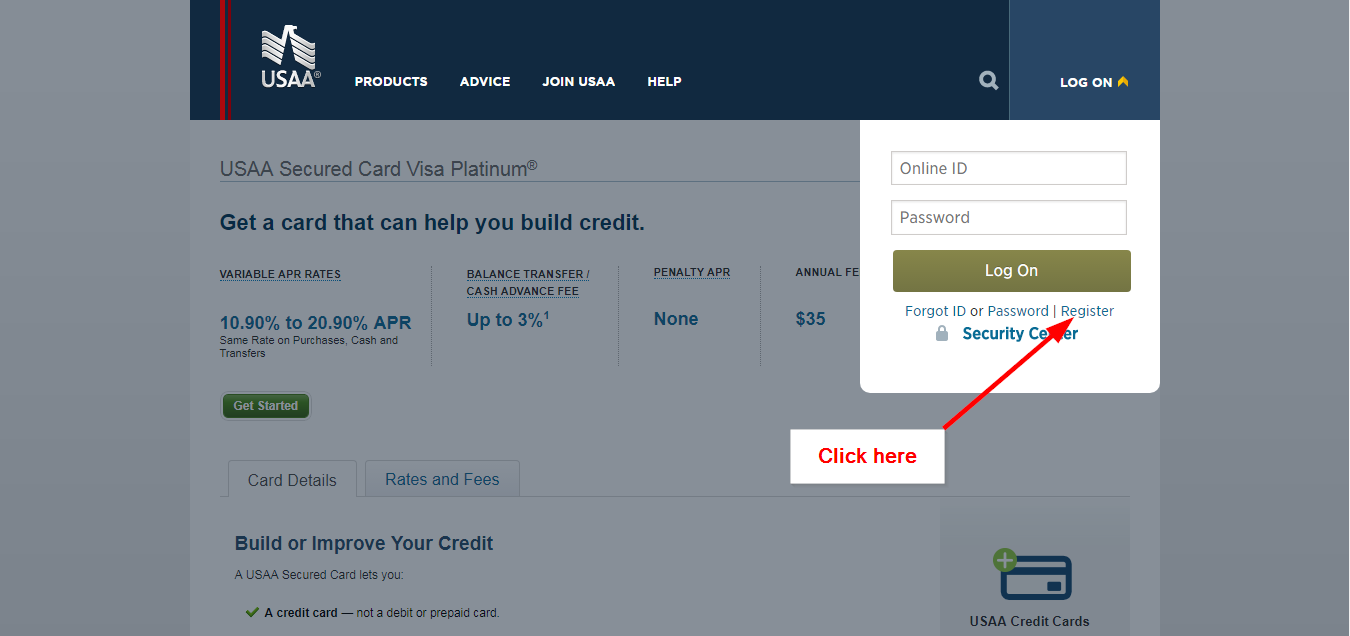

Your focus on a lender you can trust. Click on this link so you’re able to download our totally free LoanFly application, prequalify at any place, and connect with a reliable, regional loan officer that will show how much cash home your are able to afford based on your current beginner obligations levels.

Recent Comments