Discover’s household guarantee finance provides a leading minimum amount borrowed, however, large maximums. Nevertheless they promote versatile payment terminology and you may a pricing, making them an effective selection for many consumers.

Of numerous otherwise all of the organizations searched bring payment so you can LendEDU. These types of income was how exactly we care for our 100 % free service to have consumerspensation, together with instances of from inside the-depth editorial search, establishes where & just how enterprises appear on all of our web site.

- Flexible cost terminology enable it to be easy to customize their monthly payment.

- Zero fees otherwise settlement costs.

- A top minimal amount borrowed setting you would like an adequate amount off equity.

For most Americans, the most costly question loan places Mignon they’ve is their house. Today, even short home could cost thousands of cash, it is therefore an easy task to wind up having a life threatening part of your online well worth tied of your property.

If you would like cash having anything, such as for example property update or debt consolidation reduction, a property security financing makes it possible to turn a number of the residence’s worth into the cash. Generally, domestic collateral money has actually low interest rates because your home collateral will act as security.

Just in case you’ve got a great amount of security, you could potentially probably use plenty. You to definitely common lender that provides these money was Pick. This feedback will cover Discover’s family guarantee financing, if these include a great financing option for your, if in case any alternatives would-be top.

Come across is pretty flexible with respect to the home guarantee loan products. It enables you to use around 95% of equity or $2 hundred,100 , almost any is reduced.

Which highest borrowing limit, together with much time repayment preparations, form you should be in a position to loans extremely systems otherwise big expenses. For many who only need to acquire a little, or if you lack as often collateral accumulated in your residence but really, you could potentially select one of your bank’s less payment plans.

Having less fees is yet another significant perk off Discover’s loans. There aren’t any software or origination charges, no cash payment expected during the closure. A house deals and you may fund commonly feature large closing can cost you, thus having the ability to unlock that loan at no cost was a beneficial good deal.

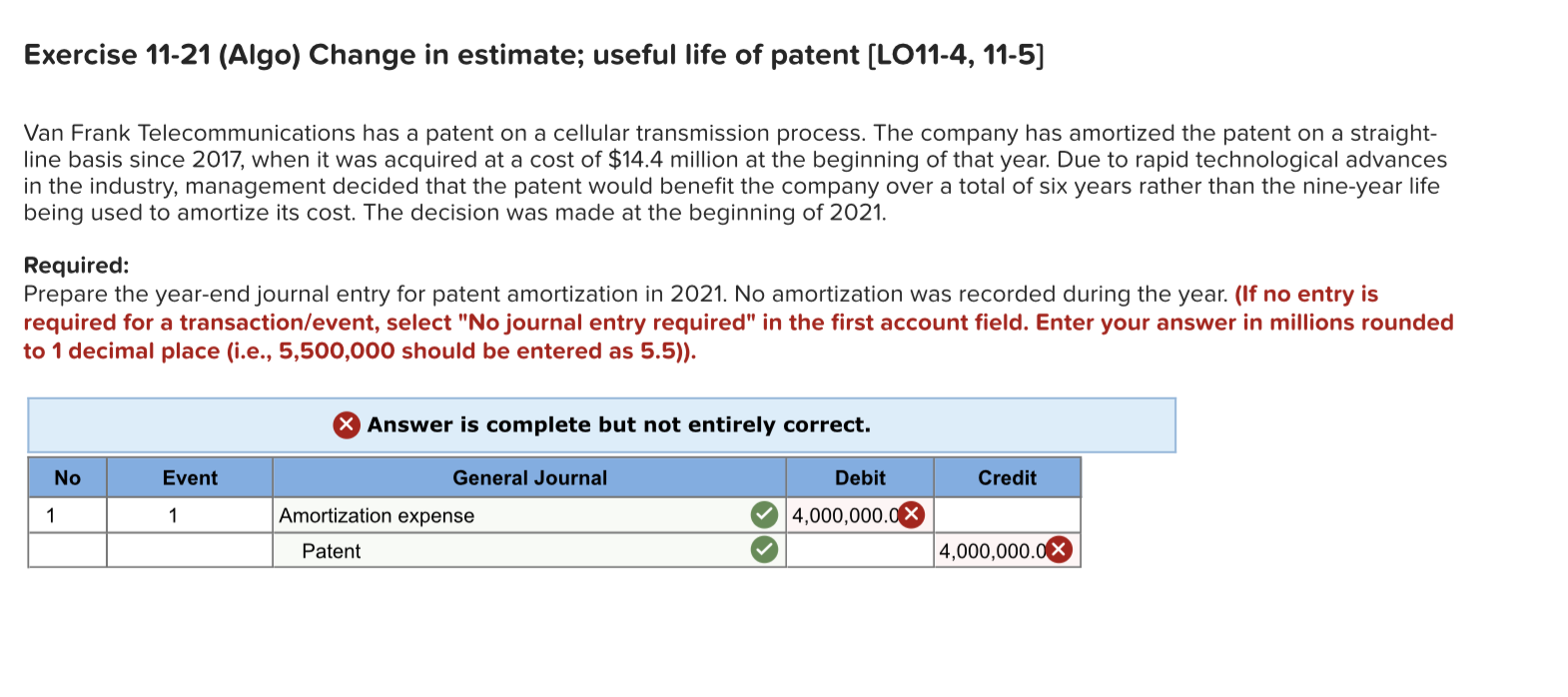

Professionals & downsides out-of Look for Home Equity Financing

- Zero charge

- Get a hold of is recognized for with strong, You.S.-oriented customer service

- Low interest

- Fixed-speed finance to have foreseeable costs

- Versatile repayment terminology

- Only those with expert credit gets a reduced cost found a lot more than

Qualification criteria & software procedure

So you’re able to be considered, you’ll want a credit history with a minimum of 620 , proven a job and you will earnings, and you can an acceptable quantity of equity of your property. Select has the benefit of financing in every county in order to residents and you will permanent residents.

Of course, locate a property collateral financing, you need to very own a property which you can use since equity to the financing. You also need getting adequate equity in order to meet Discover’s minimal mortgage off $35,one hundred thousand and you will restriction financing-to-worthy of (LTV) proportion of 95% .

Just how to use

You could potentially submit an application for a discover house collateral loan personally using Discover’s web site. Once you click the Pertain Now key it entails you to a questionnaire asking you to provide some elementary pointers, including:

Once you offer all this information, See takes into account your application. You can discover pre-certified now offers within a couple of minutes.

If you see a deal that you want, you might come across they and commence the past recognition procedure. This requires uploading documents to show the a career and you will income and handling that loan expert over the telephone.

Since the amount of the method may vary per debtor, you should buy accepted for a financial loan and also have money in your own checking account contained in this fourteen days.

What are Find household guarantee loan selection

However, of course you are credit currency, specially when your home equity is found on the range, doing your research is often wise. Reducing your interest rate by the as low as one fourth away from a percentage will save you thousands of dollars towards the a big, long-name financing.

If you would like see a whole lot more lenders, so you can contrast prequalified prices, check out our very own range of an informed family collateral financial institutions.

Recent Comments