The fresh Nationals Drama

The first popularity of B&Ls lead to producing a different sort of sort of thrift in the 1880s known as national B&L. If you find yourself these relationships operating the fundamental doing work actions used by antique B&Ls, there were numerous crucial differences. First, the nationals were usually having-earnings businesses molded from the lenders or industrialists that functioning promoters so you can form regional branches to offer offers so you can possible users. New people made the share costs at their local department, as well as the currency is actually delivered to our home work environment where it try pooled with other financing members you can expect to borrow out-of to buy house. The biggest difference in the new nationals and you can old-fashioned B&Ls try your nationals guaranteed to blow savings prices up to fourfold higher than all other lender. Since nationals including charged surprisingly higher costs and later payment fines also because high pricing toward finance, the guarantee of high production was the cause of amount of nationals in order to surge. In the event that ramifications of the new Depression from 1893 resulted in an excellent reduction in players, brand new nationals educated an unexpected reversal out of luck. Because a steady stream of new participants is crucial for an excellent national to blow the interest for the coupons plus the hefty salaries for the organizers, the latest falloff during the repayments triggered those nationals so you’re able to falter, by the termination of the new 19th century quite a few of the newest nationals was bankrupt.

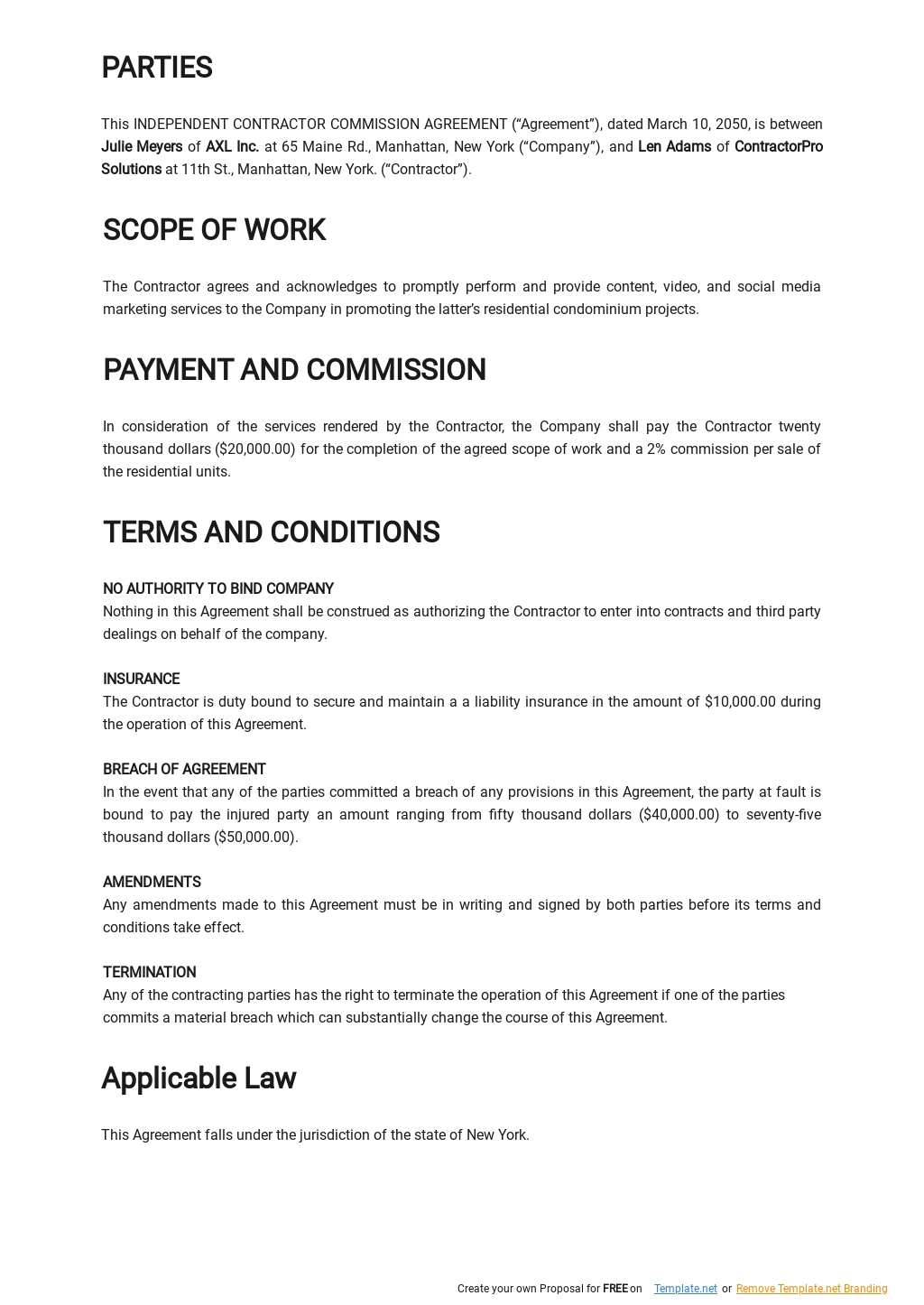

The fresh nationals crisis got several important consequences with the thrift industry, the first of which was the production of the original state legislation ruling B&Ls, tailored each other to eliminate several other nationals drama also to build thrift operations way more uniform. Notably, thrift leaders had been often responsible for protecting these types of new assistance. Another big alter was the formation of a national trading relationship not to ever simply include B&L interests, and give providers development. Such change, and improved economic conditions, hearalded into the a period of prosperity to possess thrifts, because seen less than:

Source: Carroll D. Wright, Ninth Annual Report of the Administrator off Work: Strengthening and you may Loan Associations (Arizona, D.C.: USGPO, 1894), 214; Josephine Hedges Ewalt, A business Reborn: The new Discounts https://availableloan.net/loans/no-credit-check-installment-loans/ and Financing Story, 1930-1960 (Chicago: Western Deals and Loan Institute Posting Co., 1962), 391. (All of the monetary numbers contained in this studies have been in newest dollars.)

This new federal change organization that came up regarding nationals crisis turned a well known push from inside the framing the fresh thrift community. Their leadership got an energetic role inside unifying the fresh new thrift community and you may modernizing just the surgery in addition to their photo. Brand new change connection contributed operate to create even more consistent accounting, assessment, and you will lending strategies. In addition spearheaded the newest push to own every thrifts make reference to on their own since discounts and financing not B&Ls, and to encourage professionals of the need certainly to imagine alot more elite group opportunities because financiers.

The newest consumerism of one’s 1920s fueled solid development for the business, so as that from the 1929 thrifts considering twenty two per cent of the many mortgages. Meanwhile, the typical thrift stored $704,000 into the assets, and most 100 thrifts had over $ten billion into the possessions per. Likewise, this new percentage of Americans belonging to B&Ls rose steadily so towards the end of ten years 10% of one’s populace belonged in order to a good thrift, upwards out-of just cuatro percent inside 1914. Somewhat, each one of these people was in fact higher- and you can middle-group anyone whom registered to pay currency safely and you will secure good output. Such change triggered greater globe gains since the viewed less than:

Brand new Anxiety and you may Government Controls

The new triumph for the Roaring 20s try tempered because of the financial disaster of High Depression. Thrifts, instance finance companies, suffered from mortgage loss, however in evaluation to their larger alternatives, thrifts had a tendency to survive the fresh new 1930s with better achievement. Given that banking institutions kept consult deposits, such establishments was basically more susceptible to runs by the depositors, and as a result anywhere between 1931 and you can 1932 almost 20% of all of the banks went out away from company if you’re just over dos per cent of the many thrifts came across an equivalent destiny. As amount of thrifts performed slip because of the late 1930s, a were able to rapidly cure the latest turmoil out-of the nice Despair because the seen below:

Recent Comments